Key Takeaways

- The global Artificial Pancreas Device System (APDS) market is valued at USD 2,579.4 million in 2024 and is projected to reach USD 7,768 million by 2035, growing at a CAGR of 13.00%.

- APDS closely mimics the glucose-regulating function of a healthy pancreas, integrating CGM, insulin pumps, and computer algorithms.

- Market growth is driven by rising diabetes prevalence, technological advancements, and increasing patient awareness.

- North America leads the market, with Europe and Asia Pacific showing significant growth potential.

- Major players are investing in R&D, partnerships, and product launches to strengthen their market positions.

- Future challenges include regulatory hurdles, cost barriers, and the need for further innovation.

Market Overview and Growth Projections

The Artificial Pancreas Device System (APDS) Market is experiencing a period of remarkable growth, reflecting the urgent global need for advanced diabetes management solutions. According to Vantage Market Research, the market is valued at USD 2,579.4 million in 2024 and is expected to soar to USD 7,768 million by 2035, registering a robust CAGR of 13.00% during the forecast period (2025–2035). This impressive trajectory is underpinned by several converging factors, most notably the escalating prevalence of diabetes worldwide. The International Diabetes Federation estimates that over 537 million adults are living with diabetes globally, a figure projected to rise steadily in the coming years. This surge in diabetes cases, particularly type 1 and insulin-dependent type 2 diabetes, is fueling demand for more sophisticated, automated, and user-friendly glucose management systems.

The APDS market is also benefiting from increased awareness among patients and healthcare providers about the benefits of closed-loop systems. These devices not only improve glycemic control but also significantly reduce the risk of both hyperglycemia and hypoglycemia, leading to better long-term health outcomes and quality of life. Furthermore, supportive government policies, favorable reimbursement scenarios, and growing investments in healthcare infrastructure are creating a conducive environment for market expansion. The COVID-19 pandemic has further highlighted the importance of remote monitoring and automated care, accelerating the adoption of APDS technologies. As a result, the market is witnessing heightened interest from both established medical device companies and innovative startups, all vying to capture a share of this rapidly expanding sector.

Get a Sample Copy:- https://www.vantagemarketresearch.com/artificial-pancreas-device-system-market-1335/request-sample

Device Types and Innovations

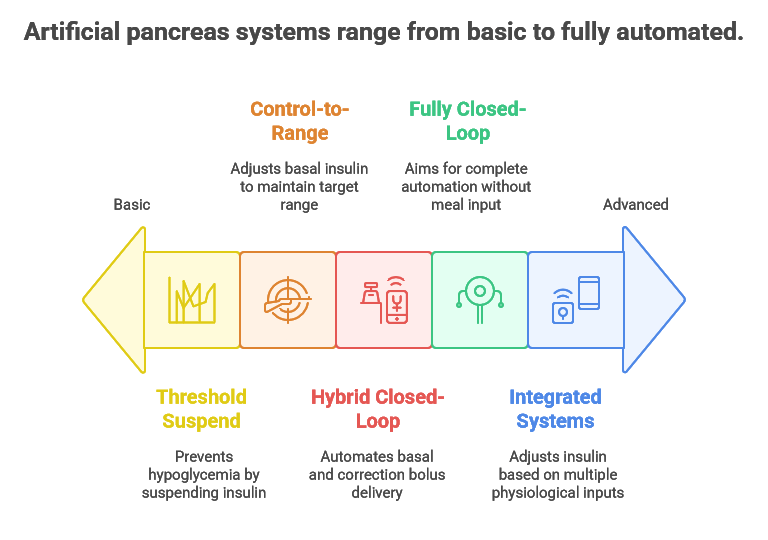

Artificial Pancreas Device Systems are at the forefront of diabetes technology, integrating multiple devices and advanced algorithms to automate insulin delivery. Most APDS solutions consist of three core components: a continuous glucose monitoring (CGM) system, an insulin infusion pump, and a computer-controlled algorithm that connects the two. The CGM continuously tracks glucose levels in real time, while the insulin pump delivers precise doses of insulin based on the algorithm’s calculations. A blood glucose meter is often used to calibrate the CGM, ensuring accuracy and reliability.

Recent years have seen significant technological advancements in APDS. Next-generation CGMs now offer longer sensor life, improved accuracy, and reduced calibration requirements. Insulin pumps have become smaller, more discreet, and easier to use, with features such as wireless connectivity and smartphone integration. The real game-changer, however, is the development of sophisticated algorithms capable of learning from user data and adapting insulin delivery in response to changing physiological conditions. Some systems are now equipped with dual-hormone delivery (insulin and glucagon), further enhancing glycemic control.

Consumer adoption trends indicate a growing preference for fully automated, “closed-loop” systems that require minimal user intervention. Patients are increasingly seeking devices that offer convenience, comfort, and peace of mind, driving demand for wearable, interoperable, and user-friendly solutions. The integration of artificial intelligence and machine learning is expected to further revolutionize the APDS landscape, enabling personalized diabetes management and predictive analytics.

Regional Market Insights

North America: Market Leader and Trends

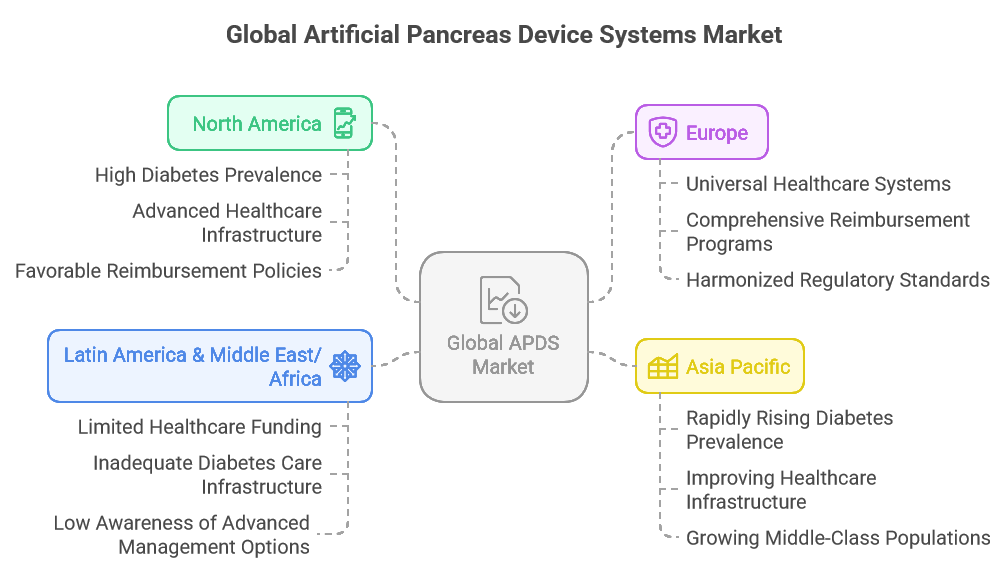

North America remains the undisputed leader in the APDS market, accounting for the largest share of global revenue. The region’s dominance is attributed to high diabetes prevalence, advanced healthcare infrastructure, and strong reimbursement frameworks. The United States, in particular, has witnessed rapid adoption of APDS technologies, supported by proactive regulatory approvals from the FDA and widespread patient education initiatives. Leading medical device companies are headquartered in North America, fostering a culture of innovation and early adoption.

Europe: Growth Drivers and Challenges

Europe is the second-largest market for APDS, with countries like Germany, the UK, and France at the forefront of adoption. The region benefits from robust healthcare systems, government support for diabetes care, and a growing emphasis on digital health. However, challenges such as varying reimbursement policies, regulatory complexities, and economic disparities between Western and Eastern Europe can hinder uniform market growth. Despite these hurdles, Europe is expected to maintain steady expansion, driven by rising diabetes incidence and increasing acceptance of automated insulin delivery systems.

Asia Pacific: Emerging Market Opportunities

Asia Pacific represents the fastest-growing region in the APDS market, fueled by a burgeoning diabetic population, improving healthcare access, and rising disposable incomes. Countries like China, India, and Japan are witnessing a surge in diabetes cases, prompting greater investment in advanced medical technologies. While the market is still in its nascent stages compared to North America and Europe, increasing awareness, government initiatives, and partnerships with global device manufacturers are unlocking significant growth opportunities. Local players are also entering the fray, offering cost-effective solutions tailored to regional needs.

Competitive Landscape and Key Players

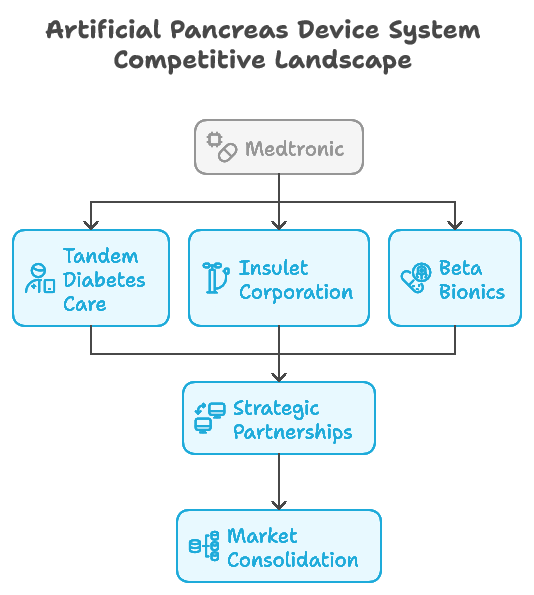

The APDS market is highly competitive, with a mix of established giants and innovative newcomers vying for market share. Major companies such as Medtronic, Tandem Diabetes Care, Insulet Corporation, and Abbott Laboratories are leading the charge, leveraging their extensive R&D capabilities, global distribution networks, and strong brand recognition. These firms offer a range of APDS solutions, from integrated systems to modular devices that can be customized to individual patient needs.

Recent years have seen a flurry of strategic moves, including mergers and acquisitions, partnerships, and product launches. For instance, Medtronic’s MiniMed 780G system and Tandem’s t:slim X2 with Control-IQ technology have set new benchmarks in closed-loop insulin delivery. Abbott’s FreeStyle Libre CGM, when paired with compatible insulin pumps, is gaining traction among tech-savvy users. Startups and smaller companies are also making waves, introducing novel algorithms, dual-hormone systems, and AI-powered platforms.

Market share analysis reveals that while a handful of players dominate the global landscape, regional competitors are gaining ground, particularly in emerging markets. The competitive intensity is expected to increase as new entrants bring disruptive technologies and as regulatory pathways become more streamlined.

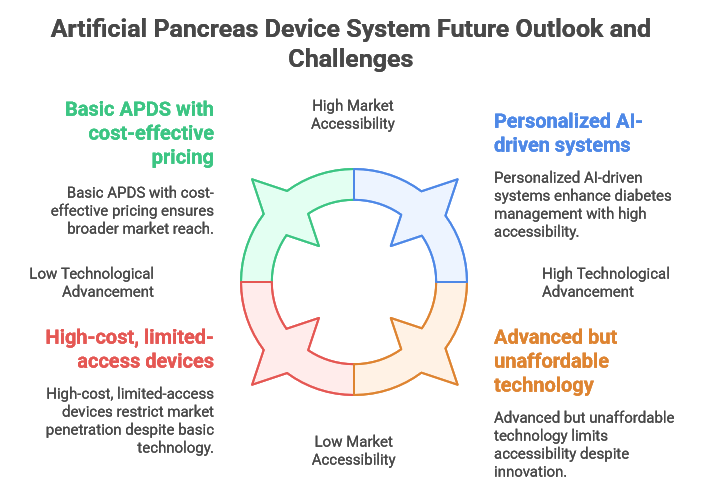

Future Outlook and Challenges

Looking ahead, the APDS market is poised for continued growth and innovation. Analysts predict that the market will not only expand in terms of revenue but also evolve in terms of technology, user experience, and clinical outcomes. The integration of artificial intelligence, cloud computing, and telemedicine will enable more personalized, data-driven diabetes management. Next-generation devices may offer multi-hormone delivery, non-invasive glucose monitoring, and seamless interoperability with other health platforms.

However, several challenges remain. Regulatory approval processes can be lengthy and complex, particularly for novel algorithms and device combinations. High costs and limited reimbursement in some regions may restrict access for certain patient populations. Ensuring data security and patient privacy in connected devices is another critical concern. Additionally, ongoing education and support are essential to maximize the benefits of APDS and ensure patient adherence.

Despite these hurdles, the future of the APDS market is bright. As technology continues to advance and as healthcare systems prioritize chronic disease management, artificial pancreas systems are set to become a cornerstone of diabetes care worldwide. Emerging opportunities for innovation, such as integration with digital therapeutics and expansion into new markets, will further drive growth and improve the lives of millions living with diabetes.

In summary, the Artificial Pancreas Device System market is on a transformative journey, driven by technological innovation, rising diabetes prevalence, and a growing demand for automated, patient-centric solutions. As the market evolves, stakeholders across the healthcare ecosystem must collaborate to overcome challenges and unlock the full potential of this life-changing technology.

![[Market Research Reports] – Research Google News Blog | VMR.Biz](https://www.vmr.biz/wp-content/uploads/2022/12/logo-removebg-preview.png)