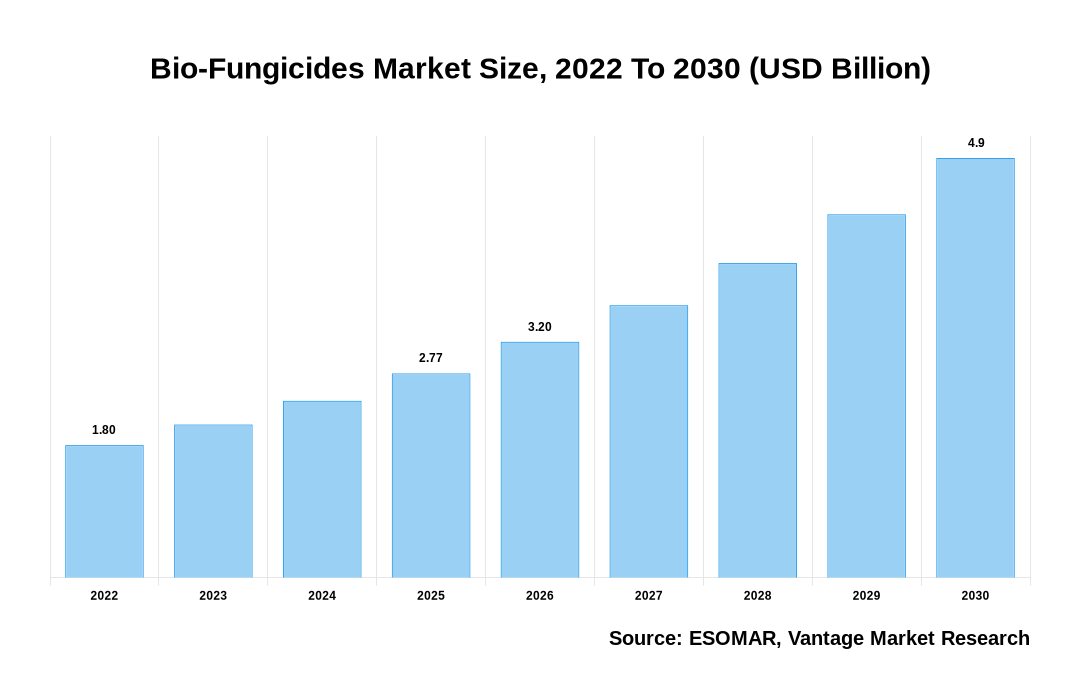

Global Bio-Fungicides Market

As stated in our extensive report; the Global Bio-Fungicides Market accounted for USD 1.8 Billion in the year 2022 and is forecast to reach USD 4.9 Billion by 2030 at a CAGR of 15.5%.

Bio-Fungicides help farmers handle plant pathogenic fungi and bacteria after they negatively impact every environment. As well as the microbial content, carrier materials for formulating Bio-Fungicides consist of considerable amounts of organic materials, like animal broth, organic materials, or organic waste products. Bio-Fungicides block the stability and sustainability of the agroecosystem after they have not negatively affected the environment.

Click To Get a Free Sample On the Research Study

Apart from the negative impacts on humans, pesticides purpose significant contamination to the environment. The purpose of pesticides, like fungicides, infect the freshwater used for agriculture, impacting the fauna and flora. Hence, many environmental organizations, similarly the Environmental Protection Agency, have to remain opposing the use of pesticides, positively affecting the increase in the use of Bio-Fungicides. Biologicals are secure and also eco-friendly different from chemical products. Bio-Fungicides are usually formulated to affect exclusively the target pathogenic fungi and are closely similar organisms in contrast to chemical fungicides, whichever frequently attempt broad sweeping coverage (non-selective) and negatively impact insects, birds, and everything else that comes in contact. Bio-Fungicides consist of natural organisms or products, accordingly, posing less threat to the environment and human health. Bio-Fungicides have earned popularity in pest management in recent decades and have long been adapted as prospective alternatives to synthetic fungicides.

However, a lack of knowledge and alertness in some of the developing economies among small-scale producers is a major aspect that will act as a challenge to market growth. Also, the dearth of necessary infrastructural facilities, huge risk of infections in regard to skin and eyes, and lack of technical abilities, especially in underdeveloped economies, will downtrend the market growth rate. Fluctuations in the prices of raw materials would further hamper the market growth rate.

COVID-19 has disrupted the agricultural industry along with a weekend supply of agricultural instruction. The disruption in the supply chain accepts the availability of fertilizers, agricultural implements, and more inputs. The closure of different manufacturing units of Bio-Fungicides during the lockdown has completed tentative market friction between demand and supply.

An immediate outbreak of the coronavirus has hit the overall global market as governments of different economies took measures to close roads and cut down overcrowding. The development is commonly expected to be imitated in the disruption and decline in productivity and organic farming due to lack of resources, lack of workers, and government-sanctioned crop closures.

Key factors influencing Bio-Fungicides Market Growth

The growth of the global Bio-Fungicides market can be attributable to the following:

- Bio-Fungicides refer to these fungicides that enclosure the microorganism as an active ingredient and are used to control fungal bacteria in plants.

- Farmers all over the world benefited from the development of sustainable products in organic farming, which is considerably contributing towards industry’s expansion.

- The growth in demand for organic fruits and vegetables globally has expanded the demand for Bio-Fungicides.

- Bio fungicides contribute longer shelf life and affordable prices for organic products, which has led to a higher preference for wettable powdered form in the overall Bio-Fungicides market.

- Farmers switching to progressive farming systems such as hydroponic systems, and aquaponics acquire a positive impact on global Bio-Fungicides market.

- Growing demand for organic food products among consumers coupled with technological advancements in the agriculture sector will further strengthen the Bio-Fungicides market potential.

North America Region to Dominate the Global Market

Based on geography, the Bio-Fungicides market is segmented toward North America, Europe, Asia-Pacific, Latin America, also the Middle East & Africa. In 2022, North America is predicted to account for the biggest share of the Bio-Fungicides market, followed by Europe and Asia-Pacific. North America’s enormous market share is primarily attributed to factors similar to the rising environmental concerns about the use of harmful chemicals, the flourishing demand for organic food, and the presence of a streamlined registration growth. In addition, the presence of certain top players in North America and the expanding adoption of eco-friendly farming process by farmers drive the growth of this regional market.

However, the market in Europe is slated to register the maximum CAGR during the forecast period. The huge market expansion in Europe is associate to the developing appeal for food safety and quality, rising consumer demand for organic products, and the growing government initiatives to promote biocontrol products.

The effects of the COVID-19 pandemic about this market remain felt in China at the opening of 2020, as the country is one of the world’s biggest raw material suppliers for the Bio-Fungicides industry. Biggest European and North American Bio-Fungicides companies import key active ingredients used in producing Bio-Fungicides from China and Asian countries. The low availability of raw materials derives in the scarcity of Bio-Fungicides products in huge-growth markets, such as the U.S., Brazil, Spain, and Italy.

Conclusion

Increasing awareness about harmful and chemical pesticides on environment is positively influencing the overall Bio-Fungicides market.

Some of the key players in the Global Bio-Fungicides market include- BASF SE (Germany), Bayer AG (Germany), Syngenta AG (Switzerland), FMC Corporation (U.S.), Unfirm (Australia), Nufarm (Australia), Novozymes (Denmark), Marron Bio Innovations (U.S.) and others.

![[Market Research Reports] – Research Google News Blog | VMR.Biz](https://www.vmr.biz/wp-content/uploads/2022/12/logo-removebg-preview.png)